Gas Fees: The Unsung Hero of Your 2025 Crypto Trading Success

Hey there, fellow crypto enthusiasts! Ever feel like you're finally about to snag that sweet, sweet profit, only to get slapped with a gas fee that makes you question your entire existence? Yeah, we've all been there. It's like finding the perfect parking spot, only to realize it's a valet-only zone charging more than your actual dinner.

Gas fees. Those pesky little charges that can make or break your trading day. Sometimes, they seem like a necessary evil, a minor inconvenience in the grand scheme of decentralized finance. Other times, they feel like a highway robbery perpetrated by digital goblins living in the blockchain. But what if I told you that understanding these fees isn't just about saving a few bucks (or satoshis)? What if it's about unlocking a whole new level of strategic trading in 2025?

Think about it: in the traditional finance world, you don't usually have to worry about a fee for every single transaction. You don't pay a "gas fee" to buy a share of stock, or to transfer money from your savings to your checking account. But in the decentralized world of cryptocurrency, gas fees are the fuel that keeps the engine running. They incentivize miners (or validators, depending on the blockchain) to process transactions and keep the network secure.

Now, I know what you're thinking: "Security is great, but does it really need to cost me so much every time I want to swap some tokens?" That's a fair question, and it's one that the crypto world is constantly trying to answer. We're seeing innovations like Layer-2 scaling solutions, sharding, and other technologies that aim to reduce gas fees and make transactions faster and more efficient.

But here's the thing: even with these advancements, gas fees are likely to remain a crucial part of the crypto landscape in 2025. And that's why understanding them is so important for traders like you and me. It's not just about avoiding those "ouch" moments when you see a ridiculously high fee. It's about using gas fees to your advantage, to make smarter trading decisions, and to ultimately increase your profitability.

So, are you ready to dive deep into the world of gas fees and discover how they can become your secret weapon in the crypto trading arena? Stick around, because we're about to unravel the mysteries of gas fees and show you how to navigate them like a pro in 2025.

Understanding Gas Fees in the Crypto Trading Landscape of 2025

The year is 2025. Flying cars might still be a distant dream, but crypto trading has become even more integrated into our daily lives. Decentralized finance (De Fi) is booming, new blockchains are emerging, and the metaverse is buzzing with activity. Amidst all this innovation, one thing remains constant: gas fees. While advancements aim to mitigate their impact, gas fees continue to play a pivotal role in the functionality and economics of blockchain networks. For traders, comprehending and strategically managing these fees is not just a cost-saving measure, but a crucial element of maximizing profitability and navigating the complexities of the crypto market.

Why Gas Fees Matter More Than Ever

In a mature crypto market, where institutional investors and sophisticated algorithms compete alongside retail traders, every fraction of a cent counts. Gas fees directly impact your bottom line. A seemingly small fee can erode profits, especially during high-frequency trading or arbitrage opportunities. Understanding how gas fees work empowers you to:

- Optimize Trading Strategies: By analyzing gas fee trends, traders can identify periods of low network congestion and execute trades at optimal times, minimizing costs and maximizing potential profits.

- Manage Risk Effectively: Unexpectedly high gas fees can trigger margin calls or force traders to close positions at unfavorable prices. A proactive approach to gas fee management allows for better risk mitigation.

- Participate in De Fi Opportunities: De Fi platforms often involve complex smart contract interactions, which can be gas-intensive. A thorough understanding of gas fees is essential for navigating De Fi protocols and capitalizing on yield farming, staking, and other lucrative opportunities.

- Choose the Right Blockchain: Different blockchains have vastly different gas fee structures. Selecting the appropriate blockchain for specific trading activities can significantly reduce transaction costs.

Navigating the Gas Fee Minefield: Practical Strategies for 2025

Okay, enough with the theory. Let's get down to some practical advice. How can you, as a savvy trader, navigate the gas fee minefield and come out on top? Here are a few strategies to consider:

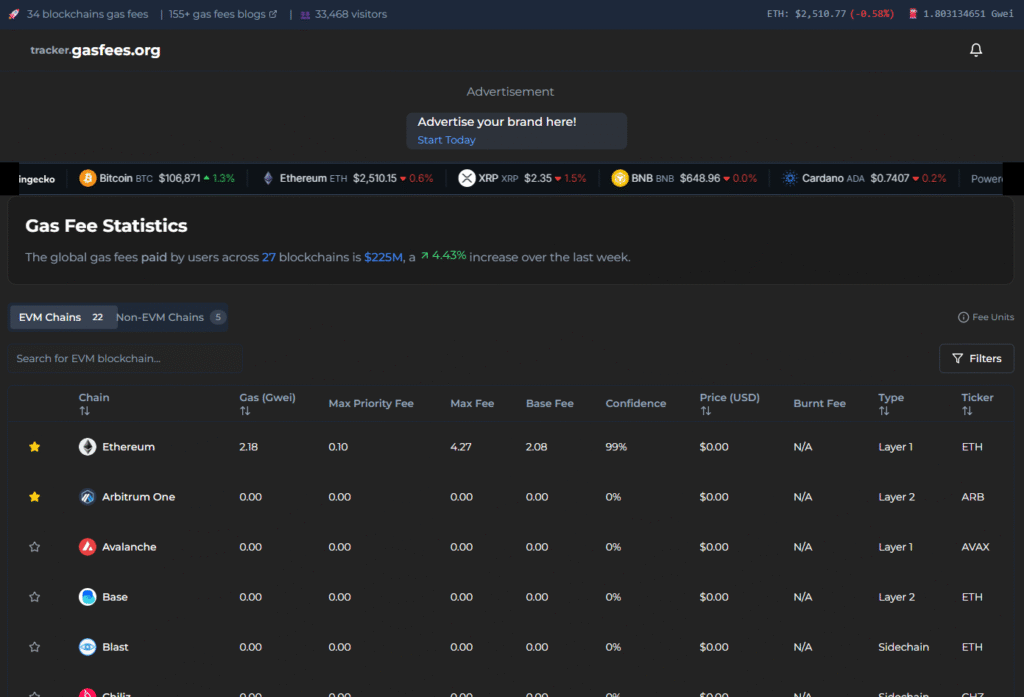

- Monitor Gas Fee Trackers: Numerous tools and websites provide real-time data on gas fees across different blockchains. These trackers can help you identify periods of low congestion and execute trades when fees are more favorable. Think of them as your personal gas fee weather forecasters.

- Utilize Gas Fee Estimation Tools: Before submitting a transaction, many wallets and exchanges offer gas fee estimation tools. These tools analyze network conditions and suggest appropriate gas prices to ensure your transaction is processed in a timely manner. While not always perfect, they can provide a valuable starting point.

- Consider Layer-2 Solutions: Layer-2 scaling solutions, such as optimistic rollups and zk-rollups, offer significantly lower gas fees compared to transacting directly on the main blockchain. These solutions bundle multiple transactions together and process them off-chain, reducing congestion and costs. Keep an eye on the development and adoption of Layer-2 solutions, as they are likely to become increasingly important in 2025.

- Explore Alternative Blockchains: Ethereum isn't the only game in town. Several alternative blockchains, such as Solana, Cardano, and Avalanche, offer lower gas fees and faster transaction times. Consider diversifying your trading activities across different blockchains to take advantage of these cost-effective alternatives.

- Batch Transactions: If you need to perform multiple transactions, consider batching them together into a single transaction. This can significantly reduce gas fees, as you only pay the base fee once for the entire batch.

- Use Limit Orders: When placing orders on exchanges, opt for limit orders instead of market orders. Limit orders allow you to specify the price at which you are willing to buy or sell, and they are only executed if the market reaches that price. This can help you avoid slippage and potentially save on gas fees.

- Automate Gas Fee Management: Advanced trading platforms may offer automated gas fee management features. These features allow you to set parameters for acceptable gas fees and automatically adjust your transactions to optimize costs.

The Future of Gas Fees: What to Expect in 2025 and Beyond

The crypto landscape is constantly evolving, and gas fees are no exception. In 2025, we can expect to see further advancements in scaling solutions, the emergence of new blockchains, and innovative approaches to gas fee management. Some key trends to watch out for include:

- Increased Adoption of Layer-2 Solutions: As Layer-2 solutions mature and become more user-friendly, their adoption is likely to increase significantly. This will lead to lower gas fees and faster transaction times for a wider range of applications.

- The Rise of Modular Blockchains: Modular blockchains separate the execution layer from the consensus and data availability layers, allowing for greater scalability and lower gas fees. This architectural approach is gaining traction and could become a major trend in the future.

- Dynamic Gas Fee Mechanisms: Traditional gas fee mechanisms often lead to unpredictable and volatile fees. Dynamic gas fee mechanisms, such as EIP-1559 on Ethereum, aim to stabilize fees and make them more predictable. We can expect to see further innovations in this area.

- Gas Fee Abstraction: Gas fee abstraction refers to the ability to pay gas fees in tokens other than the native token of the blockchain. This can simplify the user experience and make it easier for newcomers to enter the crypto space.

In conclusion, gas fees are a crucial consideration for traders in

2025. By understanding how they work, implementing effective strategies, and staying informed about the latest trends, you can navigate the gas fee minefield and maximize your profitability in the dynamic world of cryptocurrency. Remember, knowledge is power, and in the crypto market, understanding gas fees is the key to unlocking your trading potential.

Questions and Answers: Gas Fees in 2025

Let's address some common questions that traders might have about gas fees in 2025:

Question 1: Will gas fees eventually disappear altogether?

Answer: While advancements in scaling solutions aim to significantly reduce gas fees, it's unlikely that they will disappear entirely. Gas fees serve as an incentive for validators (or miners) to process transactions and secure the network. A completely free system could be vulnerable to spam and attacks. The goal is to make fees low enough to be negligible for most use cases, while still providing sufficient security.

Question 2: How do gas fees differ between various blockchains in 2025?

Answer: Gas fee structures vary significantly across different blockchains. Ethereum, while a popular platform, can experience high gas fees, especially during periods of network congestion. Alternative blockchains like Solana, Cardano, and Avalanche offer lower fees and faster transaction times. Factors influencing gas fees include the blockchain's consensus mechanism, network capacity, and demand for block space.

Question 3: What's the best way to estimate gas fees before making a trade in 2025?

Answer: Utilize gas fee estimation tools provided by wallets, exchanges, or blockchain explorers. These tools analyze network conditions and suggest appropriate gas prices based on current demand. Also, monitor gas fee trackers to identify periods of low congestion when fees are typically lower. Keep in mind that estimations aren't always perfect, so it's wise to allow for some buffer.

Question 4: How can I reduce gas fees when interacting with De Fi platforms in 2025?

Answer: Consider using Layer-2 scaling solutions that are integrated with the De Fi platform. These solutions significantly reduce gas fees compared to transacting directly on the main blockchain. Batch transactions whenever possible to combine multiple operations into a single transaction. Also, be mindful of the complexity of smart contract interactions, as more complex operations typically require more gas.

Conclusion: Master Gas Fees, Master Your Crypto Destiny

We've journeyed through the world of gas fees in 2025, uncovering their crucial role in the crypto trading landscape. We've explored strategies to navigate the gas fee minefield, from monitoring trackers to leveraging Layer-2 solutions. We've peered into the future, anticipating further advancements in scaling and gas fee mechanisms.

The key takeaway? Understanding and managing gas fees is no longer optional for crypto traders; it's essential. It's the difference between barely scraping by and achieving true profitability. It's the difference between being a passive observer and a strategic player in the decentralized revolution.

So, what's your next step? It's time to put this knowledge into action. Start by familiarizing yourself with gas fee trackers and estimation tools. Explore Layer-2 solutions and alternative blockchains. Experiment with batching transactions and setting limit orders. The more you practice and refine your gas fee management skills, the better equipped you'll be to thrive in the ever-evolving crypto market.

Don't let gas fees hold you back. Embrace them as a challenge, a puzzle to be solved. With the right knowledge and strategies, you can transform gas fees from a burden into a competitive advantage.

Are you ready to take control of your crypto destiny? The power is in your hands. Go forth, trade wisely, and may your gas fees always be low! Now, what strategies are you most excited to implement to lower your gas fees in your trading journey?