Unlock Your Future: A Beginner's Guide to Financial Freedom

Hey there, future financially-free friends! Ever feel like you're stuck in a hamster wheel, endlessly running but never really getting anywhere? We've all been there, right? Bills piling up, that dream vacation perpetually out of reach, and the constant nagging feeling that you're just not quite in control of your money. It's like your bank account is a leaky faucet – money just keeps dripping away.

Maybe you scroll through Instagram and see those "digital nomads" sipping cocktails on a beach, "working" from their laptop, and think, "Yeah, right. That's not for me." Or perhaps you've even dabbled in investing, only to get burned by a volatile market and swear off anything riskier than a savings account. But here's the thing: financial freedom isn't some mythical unicorn only attainable by the ultra-rich. It's a journey, not a destination, and it's absolutely within your reach, no matter where you're starting from. Think of it less like winning the lottery and more like learning to ride a bike – wobbly at first, maybe a few scrapes, but eventually, you're cruising along with the wind in your hair (or helmet, safety first!).

Let's face it: the traditional "work hard, retire at 65" model is looking increasingly outdated. Pensions are disappearing, social security is uncertain, and frankly, who wants to wait until their golden years to actually enjoy their life? Financial freedom is about creating a life where you have options. It's about having the flexibility to pursue your passions, spend time with loved ones, and not be chained to a job you hate just to pay the bills. It's about building a safety net so you can weather unexpected storms (like that leaky faucet turning into a full-blown plumbing emergency!).

But where do you even begin? The world of finance can seem overwhelming, filled with jargon and complex strategies. Should you invest in stocks? Real estate? Cryptocurrency? What's a Roth IRA anyway? It's enough to make your head spin. And the internet? Forget about it! You'll find a million conflicting opinions, each claiming to have the "secret" to wealth. It's a jungle out there!

That's where this guide comes in. We're going to break down the basics of financial freedom into manageable, actionable steps. No complicated formulas, no get-rich-quick schemes, just solid, practical advice that you can start implementing today. We'll ditch the jargon, cut through the noise, and show you how to build a solid foundation for a financially secure future. Consider this your personal roadmap to freedom – a step-by-step guide to taking control of your money and building the life you've always dreamed of. So, buckle up, because it all starts with understanding a few key principles. Are you ready to ditch the hamster wheel and start building a life of freedom and abundance?

The Roadmap to Financial Freedom: Your Journey Begins Now

So, you’re ready to take charge of your financial future? Awesome! Let's dive into the practical steps you can take, starting today. Remember, it’s a marathon, not a sprint. Small, consistent actions will get you further than trying to do everything at once.

Master the Basics: Budgeting and Tracking

• Understand where your money is going. This might seem obvious, but most people have no clue where their money disappears each month. It's like trying to navigate without a map – you'll probably end up lost and frustrated.

• Tools to help you: Mint, YNAB (You Need a Budget), Personal Capital, or even a simple spreadsheet. The key is to track every expense, from your morning coffee to your monthly rent.

• Categorize your spending: Differentiate between needs (housing, food, transportation) and wants (that fancy new gadget, eating out every night). This will help you identify areas where you can cut back.

• Create a realistic budget: Don't set unrealistic restrictions that you can't stick to. Start with small changes and gradually adjust as you become more comfortable. Maybe cut back on eating out once a week, or switch to a cheaper coffee brand.

• Automate your savings: Treat your savings like a bill you have to pay each month. Set up automatic transfers from your checking account to a savings or investment account. Pay yourself first!

Crush Debt: The Freedom Killer

• List all your debts: Include the balance, interest rate, and minimum payment for each. Seeing the full picture can be scary, but it's the first step towards tackling it.

• Choose a debt repayment strategy: The two most common are the debt snowball (focus on paying off the smallest debt first for a psychological win) and the debt avalanche (focus on the debt with the highest interest rate to save money in the long run).

• Increase your payments: Even a small increase in your monthly payments can make a big difference in the long run. Find ways to free up extra cash, such as cutting back on unnecessary expenses or selling items you no longer need.

• Negotiate lower interest rates: Call your credit card companies and ask if they'll lower your interest rate. You might be surprised at how often they're willing to work with you.

• Consider debt consolidation: If you have multiple high-interest debts, you might be able to consolidate them into a single loan with a lower interest rate.

Build an Emergency Fund: Your Financial Safety Net

• Start small: Even a small amount of savings is better than nothing. Aim to save at least $1,000 as quickly as possible. This will cover most minor emergencies and prevent you from going into debt.

• Automate your savings: Set up automatic transfers from your checking account to a high-yield savings account. This will make saving effortless.

• Gradually increase your savings goal: Once you've reached $1,000, aim to build up to 3-6 months' worth of living expenses. This will provide a cushion in case of job loss, unexpected medical bills, or other emergencies.

• Keep your emergency fund liquid: This means you should be able to access the money quickly and easily. A high-yield savings account is a good option. Avoid investing your emergency fund in stocks or other volatile assets.

• Don't touch it unless it's a real emergency: This is crucial! Resist the temptation to dip into your emergency fund for non-essential expenses. This is your safety net, so protect it.

Invest for the Future: Grow Your Wealth

• Start early: The earlier you start investing, the more time your money has to grow. Thanks to the power of compounding, even small investments can grow significantly over time.

• Understand the basics of investing: Learn about different investment options, such as stocks, bonds, mutual funds, and ETFs. Understand the risks and potential rewards of each.

• Consider your risk tolerance: Are you comfortable with the possibility of losing money in exchange for potentially higher returns? Or are you more risk-averse and prefer a more conservative approach?

• Utilize tax-advantaged accounts: Take advantage of retirement accounts like 401(k)s and IRAs to reduce your tax burden and boost your savings.

• Diversify your investments: Don't put all your eggs in one basket. Spread your investments across different asset classes to reduce risk.

• Invest for the long term: Don't try to time the market or chase after hot stocks. Invest in a diversified portfolio and hold it for the long term, riding out the ups and downs of the market.

Increase Your Income: Earn More Money

• Negotiate a raise: Research the average salary for your position and experience level in your area. Prepare a compelling case for why you deserve a raise, highlighting your accomplishments and contributions to the company.

• Explore side hustles: Consider starting a side hustle to earn extra income. This could be anything from freelancing to driving for a rideshare company to selling handmade crafts online.

• Develop new skills: Invest in yourself by learning new skills that are in demand. This could make you more valuable to your current employer or open up new career opportunities.

• Start a business: If you're feeling entrepreneurial, consider starting your own business. This can be a great way to earn more money and gain more control over your time.

• Sell unused items: Declutter your home and sell items you no longer need online or at a consignment shop. This is an easy way to generate extra cash.

Protect Your Assets: Insurance and Legal Planning

• Get adequate insurance coverage: Make sure you have adequate health, auto, home, and life insurance to protect yourself from financial losses in case of an emergency.

• Create a will: A will is a legal document that outlines how you want your assets to be distributed after your death. This is especially important if you have children or significant assets.

• Consider a living trust: A living trust is a legal document that allows you to transfer your assets to a trust while you're still alive. This can help you avoid probate and protect your assets from creditors.

• Protect your identity: Be vigilant about protecting your personal information to prevent identity theft. Monitor your credit report regularly and be cautious about sharing your social security number or other sensitive information online.

Continuously Learn and Adapt

• Read books and articles on personal finance: There are tons of great resources available to help you learn more about personal finance.

• Follow personal finance blogs and podcasts: Stay up-to-date on the latest trends and strategies by following personal finance blogs and podcasts.

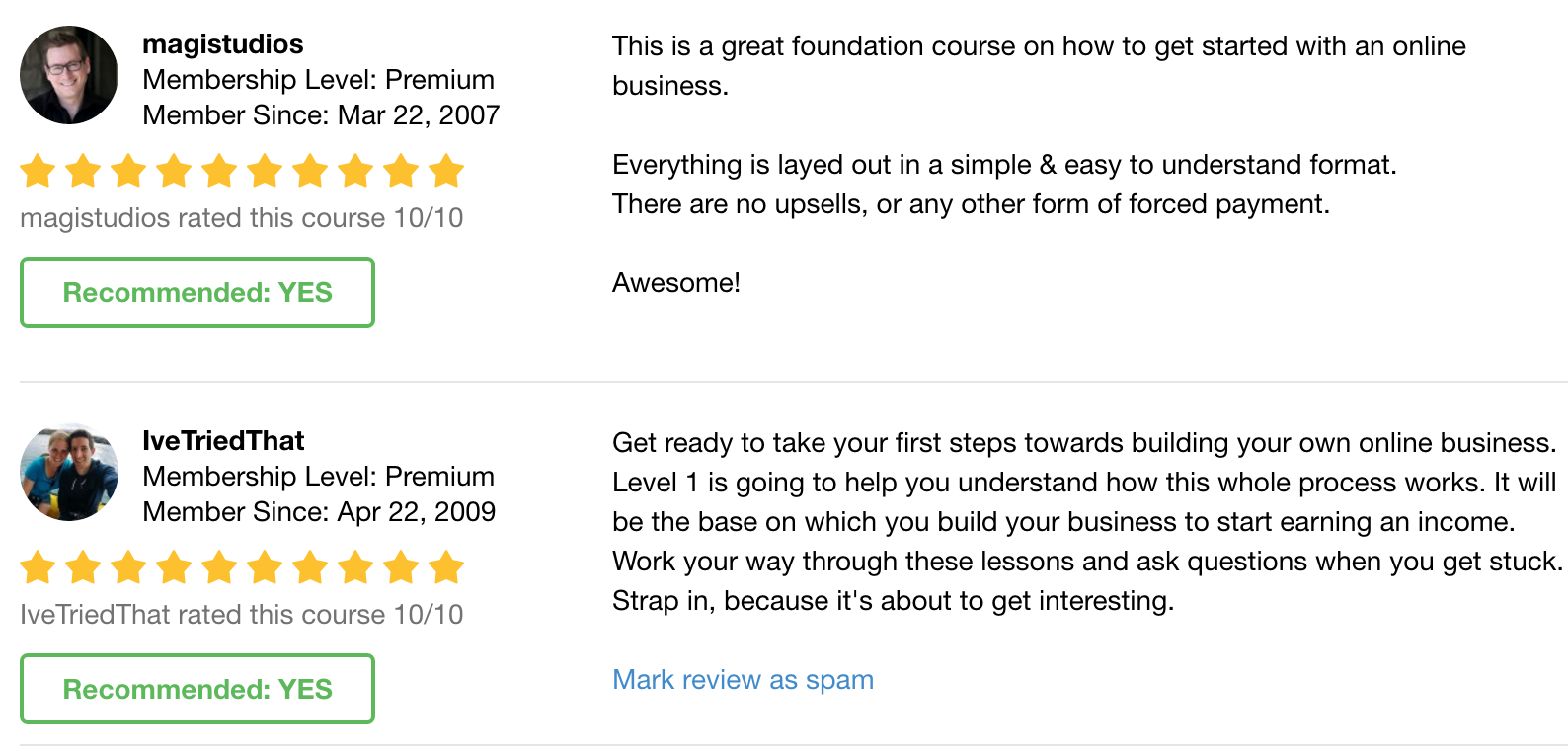

• Take online courses: Consider taking online courses to learn more about specific topics, such as investing or budgeting.

• Network with other financially savvy people: Connect with other people who are interested in financial freedom. Share ideas and learn from each other.

Remember, financial freedom is a journey, not a destination. There will be setbacks and challenges along the way. But if you stay focused on your goals and keep learning and adapting, you can achieve your financial dreams. You've got this!

Frequently Asked Questions About Financial Freedom

Okay, let's tackle some common questions that often pop up when people start thinking about financial freedom.

Q: How much money do I need to be financially free?

A: This is the million-dollar question (pun intended!). The truth is, it's different for everyone. It depends on your lifestyle, your expenses, and your goals. A good rule of thumb is to calculate your annual expenses and then multiply that number by 25. This will give you a rough estimate of how much you need to have saved to cover your expenses without working, assuming you can withdraw 4% of your savings each year. However, don't get hung up on a specific number. Focus on making progress towards your goals, whatever they may be. Remember, financial freedom isn't just about having a certain amount of money. It's about having control over your time and your choices.

Q: Is it too late for me to start working towards financial freedom?

A: Absolutely not! It's never too late to start. While starting earlier gives you the advantage of compounding interest, you can still make significant progress at any age. The key is to start now and be consistent. Focus on what you can control: your spending, your saving, and your earning potential. Even small changes can make a big difference over time. Think of it like planting a tree: the best time to plant it was 20 years ago, but the second best time is now.

Q: What if I make a mistake with my investments?

A: Mistakes happen! Everyone makes them, even experienced investors. The important thing is to learn from your mistakes and not let them discourage you. Don't panic sell if your investments lose value. Remember that investing is a long-term game. Focus on diversification and stick to your plan. If you're unsure about something, seek advice from a qualified financial advisor.

Q: Can I achieve financial freedom if I have a low income?

A: It may take longer, but it's definitely possible! When you have a lower income, you need to be even more diligent about budgeting, saving, and finding ways to increase your income. Look for opportunities to cut expenses, such as negotiating lower bills or finding cheaper housing. Consider starting a side hustle to earn extra money. Focus on building skills that are in demand and that can increase your earning potential. Remember, every little bit helps. Small, consistent actions can add up to big results over time.

The Path Ahead: Embrace Your Financial Future

So, there you have it – your beginner's guide to financial freedom! We've covered a lot of ground, from mastering the basics of budgeting and debt repayment to building an emergency fund, investing for the future, and increasing your income. Remember, this is a journey, not a destination. There will be ups and downs, challenges and setbacks. But if you stay focused on your goals, keep learning and adapting, and take consistent action, you can absolutely achieve your financial dreams.

The core message here is empowerment. Financial freedom isn't some abstract concept reserved for the lucky few. It's a tangible goal that you can achieve by taking control of your finances and making smart decisions. It's about building a life where you have options, where you can pursue your passions, spend time with loved ones, and not be chained to a job you hate just to pay the bills.

Now, it's time to take action! Start by implementing just one or two of the strategies we've discussed. Maybe it's creating a budget, tracking your expenses, or setting up automatic transfers to a savings account. Whatever you choose, make a commitment to taking that first step today. Don't wait for the perfect moment, because it will never come. Start now, and start small.

I challenge you to take one action today towards your financial freedom goals. Whether it's opening a high-yield savings account, or calculating your debt, or even just researching a new investment strategy, commit to taking that first step! I know you can do it!

Now, go out there and build the life you've always dreamed of! You've got this! Are you ready to start your journey to financial freedom today?