Unlock Your Golden Years: Crafting a Diversified Retirement Income Stream

Hey there, future retiree! Let's talk about something super important, yet often swept under the rug until it's almost too late: retirement income. Imagine this: you're finally free from the 9-to-5 grind, ready to travel the world, spoil the grandkids, or simply relax with a good book. But what if your carefully planned retirement nest egg isn't quite enough? What if unexpected expenses pop up, or the market takes a nosedive right when you need it most? (Cue the dramatic music!).

Retirement can sometimes feel like that never-ending math problem we dreaded in school, am I right? You try to crunch all the numbers, make assumptions about future returns, and hope everything adds up. Then, BAM! Life throws a curveball, like a global pandemic or inflation rates that make your grocery bill scream. Suddenly, that retirement plan you thought was solid feels a little shaky.

And let's be honest, relying solely on one or two sources of income, like Social Security and a 401(k), is like putting all your eggs in one fragile basket. It's a recipe for anxiety and potential financial hardship. Social Security might not be as robust as we hope, and those market fluctuations can seriously mess with your retirement savings. Are you starting to feel a little stressed? Don't worry, friend, because there's a better way!

What if I told you there's a way to create a retirement income stream that's as diverse and resilient as a lush rainforest? A system that's not easily knocked off course by market volatility or unexpected life events? Sounds pretty good, right?

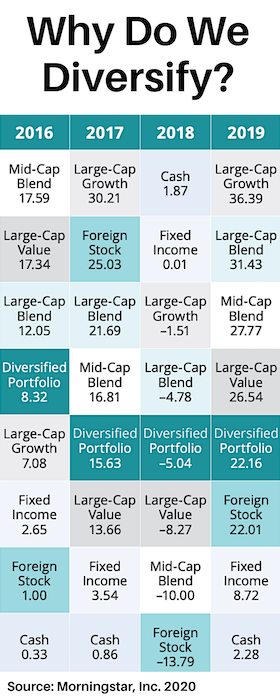

That's where diversifying your retirement income comes in. It's about building a portfolio of different income sources that work together to provide a steady and reliable flow of cash throughout your retirement years. Think of it as planting multiple seeds, each with the potential to blossom into a thriving source of income. This isn't just about surviving retirement; it's about thriving, enjoying, and living your golden years to the fullest! Ready to learn how to create your own personal retirement rainforest? Keep reading, because we're about to dive in!

Crafting Your Retirement Income Rainforest: A Step-by-Step Guide

So, you’re intrigued by the idea of a retirement income rainforest? Great! It's time to get down to brass tacks and explore some actionable strategies for diversifying your income streams. This isn't a one-size-fits-all approach; it's about tailoring a plan to your unique circumstances, risk tolerance, and retirement goals. Think of it as building your own custom retirement masterpiece, one income stream at a time.

• Maximize Social Security

Social Security is often the bedrock of retirement income for many people, so it's essential to get the most out of it. Did you know that the age you claim Social Security benefits can significantly impact your monthly payments? You can start receiving benefits as early as age 62, but your payments will be reduced. Waiting until your full retirement age (FRA), which is typically 66 or 67, will get you your full benefit amount. And if you delay claiming until age 70, you'll receive an even larger payment. This is a great option if you don't need the money right away and want to maximize your lifetime benefits.

Think of it like this: claiming early is like picking an unripe fruit – you get it sooner, but it's not as sweet. Waiting until 70 is like letting that fruit ripen to perfection, resulting in a much more satisfying reward. Also, be sure to check your Social Security statement online to ensure your earnings history is accurate. Any errors could affect your benefit amount.

• Tap into Tax-Advantaged Retirement Accounts

Your 401(k)s, IRAs, and other retirement accounts are valuable assets that can provide a steady stream of income during retirement. But it's not just about having these accounts; it's about strategically managing them. Consider your withdrawal strategy carefully. A common approach is the "4% rule," which suggests withdrawing 4% of your portfolio each year. However, this rule might not be suitable for everyone, especially with increasing life expectancies and market volatility.

Instead, consider working with a financial advisor to develop a personalized withdrawal plan that considers your individual circumstances. Also, be mindful of the tax implications of withdrawals. Roth accounts offer tax-free withdrawals in retirement, while traditional accounts are taxed as ordinary income. Strategically managing your withdrawals from different account types can help minimize your tax burden and maximize your retirement income.

• Explore Real Estate Investments

Real estate can be a powerful tool for generating retirement income, but it's not without its risks. Rental properties can provide a steady stream of cash flow, but they also require ongoing management and maintenance. Being a landlord isn't for everyone! If you don't want to deal with tenants and leaky faucets, consider other real estate options like REITs (Real Estate Investment Trusts). REITs allow you to invest in a portfolio of real estate properties without directly owning or managing them. They can provide a relatively stable income stream and diversification benefits.

Another option is to downsize your home. If you're living in a large house with lots of unused space, consider selling it and moving to a smaller, more manageable property. This can free up a significant amount of capital that you can use to invest or generate income. It's like decluttering your house and your finances at the same time!

• Embrace the Gig Economy

Retirement doesn't have to mean completely stopping work. Many retirees enjoy staying active and engaged by working part-time or pursuing freelance opportunities. The gig economy offers a plethora of options, from driving for ride-sharing services to offering consulting services in your area of expertise. Not only can this provide a valuable source of income, but it can also help you stay mentally sharp and socially connected.

Think about your skills and passions. What do you enjoy doing? What are you good at? There's a good chance you can monetize those skills and turn them into a retirement income stream. Plus, the gig economy offers flexibility, allowing you to work when and where you want. It's like having your own personal retirement side hustle!

• Invest in Dividend-Paying Stocks

Dividend-paying stocks can be a great source of passive income during retirement. These are stocks of companies that regularly distribute a portion of their profits to shareholders in the form of dividends. Investing in a diversified portfolio of dividend-paying stocks can provide a steady stream of income that supplements your other retirement income sources. Look for companies with a history of consistently paying and increasing dividends. These companies are often financially stable and have a track record of returning value to shareholders.

However, it's important to remember that dividends are not guaranteed. Companies can cut or eliminate their dividends if they experience financial difficulties. So, it's essential to do your research and choose dividend-paying stocks carefully. Consider working with a financial advisor to build a dividend portfolio that aligns with your risk tolerance and retirement goals. It's like planting a money tree that provides a steady harvest of dividends!

• Consider Annuities

Annuities are insurance contracts that provide a guaranteed stream of income for a specified period, or for life. They can be a valuable tool for ensuring that you have enough income to cover your essential expenses during retirement. There are different types of annuities, each with its own features and benefits. Immediate annuities start paying out income right away, while deferred annuities allow you to accumulate assets over time before starting to receive payments. Fixed annuities offer a guaranteed rate of return, while variable annuities allow you to invest in a portfolio of stocks and bonds. It's important to understand the different types of annuities and choose the one that best meets your needs. Also, be aware of the fees associated with annuities, as they can eat into your returns. Talking to a financial advisor can help you determine if an annuity is right for you. It's like having a financial safety net that provides a guaranteed income stream!

• Monetize Your Hobbies

Do you have a hobby that you're passionate about? Perhaps you enjoy gardening, knitting, painting, or playing a musical instrument. Why not turn that hobby into a retirement income stream? You could sell your creations online, teach classes, or offer your services to others. This is a great way to generate income while doing something you love. It's like getting paid to do what you enjoy! Plus, it can help you stay active, engaged, and connected with others.

For example, if you're a skilled gardener, you could offer gardening services to your neighbors or sell your produce at a local farmers market. If you're a talented knitter, you could sell your knitted items on Etsy or teach knitting classes at a community center. The possibilities are endless! All it takes is a little creativity and entrepreneurial spirit.

• Peer-to-Peer Lending

Peer-to-peer lending is an alternative investment that allows you to lend money to individuals or businesses through online platforms. In return, you receive interest payments on your loans. Peer-to-peer lending can offer higher returns than traditional savings accounts or bonds, but it also comes with higher risks. There's a risk that borrowers may default on their loans, resulting in a loss of principal. It's important to diversify your investments across multiple loans to reduce your risk. Also, be sure to thoroughly research the lending platform and understand the terms and conditions of the loans before investing. Peer-to-peer lending can be a good option for investors who are comfortable with taking on some risk in exchange for potentially higher returns. It's like being your own bank and earning interest on your loans!

Retirement Income Diversification: Frequently Asked Questions

Okay, friends, I know you might still have some questions swirling around in your head about this whole retirement income diversification thing. Let's tackle some of the most common ones head-on!

Question 1: How much income do I actually need in retirement?

Answer: Ah, the million-dollar question! (Or, hopefully, more like a slightly-less-than-a-million-dollar question!) The truth is, it varies wildly depending on your lifestyle, location, and healthcare needs. A good starting point is to estimate around 70-80% of your pre-retirement income. However, that's just a general guideline. Consider your specific expenses: housing, food, transportation, healthcare, travel, hobbies, and anything else you plan to spend money on. Don't forget to factor in inflation, which can erode your purchasing power over time. Online retirement calculators can be helpful, but the best approach is to create a detailed budget and consult with a financial advisor.

Question 2: Is it too late to diversify my retirement income if I'm already close to retirement?

Answer: Absolutely not! While it's ideal to start diversifying early, it's never too late to make positive changes. Even if you're just a few years away from retirement, you can still explore options like part-time work, downsizing, or investing in dividend-paying stocks or annuities. The key is to be realistic about your options and make a plan that aligns with your timeframe and risk tolerance. Don't panic! Just take a deep breath, assess your situation, and start taking small steps in the right direction.

Question 3: How do I balance risk and reward when diversifying my retirement income?

Answer: This is a crucial consideration! Diversification itself helps to mitigate risk, but it's important to understand the risk profiles of different income sources. For example, stocks and real estate tend to offer higher potential returns but also come with greater volatility. Annuities and Social Security provide more predictable income streams but may have lower returns. Your ideal balance will depend on your risk tolerance, age, and financial goals. A younger retiree might be comfortable with a higher allocation to stocks, while an older retiree might prefer a more conservative approach with a greater emphasis on guaranteed income. Consider working with a financial advisor to create a portfolio that's tailored to your specific needs and comfort level.

Question 4: What are the tax implications of different retirement income sources?

Answer: Taxes can significantly impact your retirement income, so it's essential to understand the tax rules associated with each income source. Social Security benefits may be taxable, depending on your income level. Withdrawals from traditional 401(k)s and IRAs are taxed as ordinary income. Roth IRA withdrawals are tax-free. Investment income, such as dividends and capital gains, is also taxable. Annuities have complex tax rules that depend on the type of annuity and how it's structured. Consulting with a tax advisor can help you minimize your tax burden and maximize your retirement income. Tax planning is an essential part of retirement planning!

Securing Your Future: A Final Thought

Alright, friends, we've covered a lot of ground! Remember, building a diversified retirement income stream isn't about getting rich quick; it's about creating a secure and sustainable financial future for yourself. By diversifying your income sources, you can reduce your reliance on any single source of income and increase your financial resilience. This can give you peace of mind knowing that you're prepared for whatever life throws your way. Don't be afraid to explore different options and find what works best for you. Start small, be patient, and seek professional advice when needed.

Now that you're armed with this knowledge, it's time to take action! Start by assessing your current retirement income situation. Identify any gaps and explore opportunities to diversify your income streams. Make a plan, set goals, and track your progress. And most importantly, don't be afraid to ask for help. A financial advisor can provide personalized guidance and help you create a retirement income plan that's tailored to your specific needs.

Remember, retirement isn't the end of the road; it's the beginning of a new adventure! By taking control of your finances and diversifying your retirement income, you can unlock your golden years and live the retirement you've always dreamed of. So, go out there and create your own personal retirement income rainforest! What's one small step you can take today to start diversifying your retirement income?